Whether you have a disability pension (for example, Ontario Disability Support Pension – ODSP) or you receive a pay cheque from employment, the money you have available to use is likely limited. When you do not have access to unlimited funds, it is important to ensure that your basic needs (e.g. rent) and fixed costs (e.g. cable) are met as well as being able to put some money aside for your dreams, your goals and for emergencies. This requires that you set up a budget to plan out the money you have available and how you are going to spend it.

However, before you can set up a budget, you need to know where you are spending your money. Most people do not have a good idea of what they are spending their money on. We usually don’t remember what we have bought. We just know that we had more money in our pocket than we do now. Much of this spending is for small knick-knacks or snack food that we regularly buy without really thinking about it. The total spent can add up very quickly. This effect has been called the ‘latte factor’. If you buy one coffee per day at Tim Horton’s costing $1.50, this will add up to $10.50 in a week, $45 in a month or $540 in a year – enough to buy a good TV or take a summer vacation.

5 easy steps to taking control of your spending rather than your spending controlling you.

It would be a good idea to get some help with this from someone you trust. This could be a parent, other family member, a staff, a friend or a volunteer.

- For a week or two keep track of everything that you buy. Keep all of your receipts and use a notebook or the attached daily log to record daily expenditure amounts and the amounts earned.

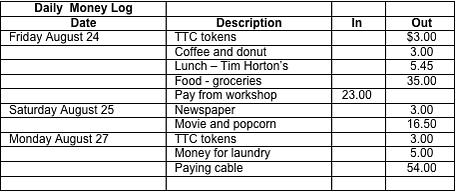

Sample Daily Log

- At the end of the week, group together all similar expenses i.e. food/ entertainment/ personal needs/ transportation/ snacks/ coffee. This lets you know how your money is spent. Use the attached Expense and Income Summary form

- For each of the groupings, decide whether it was money worth spending. Record yes or no on the last line of the Expense and Income tabulation form.

For example, if you spent $50 on food, were you okay with the amount and type of food you had? Did it meet your needs for meals? If it did not, then you should decide if you require more money for food or if you can change the type of food you are buying.

For another example, let’s say that on the way home each day you stop at the corner store to buy a bottle of coke and some chips. At the end of the week you have spent $40 on these. Rate how much satisfaction you got from eating the snacks each day. Do you even remember? Was it just something you do out of habit? If so, then you may want to think about what else you could have spent the money on that would mean more to you. Do you have a goal in mind? Maybe it would be better to save this money for that.

- Now that you know what you presently spend your money on and whether it is money well spent, let’s look at what you want to spend your money on in the future. Make 2 lists. Title the first list ‘Basic Needs and Fixed Costs’ and include your expenses that you need to pay, such as rent, food, clothing, transportation, phone, cable. For each of these expenses decide whether the amount you spend (step 2) is okay or do you want to spend more or less money.

- The second list titled, ‘Goals and Wish List Spending’, includes any goals, activities or purchases that you are planning in the next year that require money. For each of these items decide how much money you need. Then rate them according to how important each one is for you to achieve (with 1 being the most important).

You are now ready to create your budget using the new information you have gathered from completing the five steps above. Take a look at the ‘Budgeting 101 – Creating a Budget’ article for more details on how to create a budget.