Spending money is something everyone does. Spending is a combination of things we have to pay for and things we want. Every month we have to make sure we leave enough for necessities. Necessities are the things we have to pay for, such as rent and groceries. A good strategy to help you pay for your necessities is to make a budget at the start of each month. A budget is a plan of how you will spend your money and how to make your money last while covering all of your expenses.

To begin a budget you need to know how much money you will be receiving and how much your bills will cost. Bills might include your rent, utilities, phone bill, cable TV bill and cell phone bills. Food and groceries are another expense most of us have each month.

After you set money aside for your bills and groceries you can see how much is leftover, and plan for how you want to spend your remaining money. This list is different for each person. It might include new clothes, cigarettes, entertainment, such as movies and bowling, restaurant meals and even savings.

For more information on budgets see the article Creating A Budget.

Making your budget is the easy part. The harder part is sticking to your budget. There are many stores and places you can spend money. Businesses are very good at convincing people to spend their money. You will need to find strategies to slow down the buying process. Sometimes you walk into a store or see an ad on TV, and the item you are looking at looks so good you think you absolutely have to buy it. There is nothing wrong with buying something new, but you must first make sure that if you do buy that item, you will still have enough money left for the things you need (our necessities). If you spend a lot of money on one thing, you might not have the money to buy other things you want. Slow down and give yourself time to think about whether you really want to buy something.

Seeing something you want and buying it right away is called impulse buying. Instead of doing this, you might want to take some time and think about it before spending the money. You could ‘sleep on it’. That would mean not buying the item right away and taking a day to think about the good reasons and the bad reasons about buying it. Talk to someone you trust about your reasons for and against buying something. Do not talk to the sales person, because they might not give you a straight answer. Remember, the salesperson earns money when you buy something from them. After talking to someone you trust and taking the time to think about it, you may decide you do want the item and you will spend your money on it. Or you may decide you do not actually want the item and would rather keep your money for other things.

Buyer Beware

Similar items can cost different prices at different places. It is a wise idea to shop around which means to look for similar items at different stores. To make sure you get the best possible price, look for an item at different stores before buying it. For example, when buying groceries using flyers will help you see what is on sale, and can help you make decisions that will leave you with more money in your pocket. A can of soup may cost $1.50 at one store and only cost $1.00 at another store.

Businesses want you to buy their products. It is your job to make sure you want and need what they are trying to sell you. Similar items can be different prices because they are not really the same. For example, one camera might cost $25 and another camera might cost $300. It could be that the $300 camera does more things and is better quality. If that is what you need and have budgeted the money to buy it, then you may decide the more expensive camera would be a good thing to buy. However, you may decide that you do not have enough money for the $300 camera and that the $25 one is good enough for your needs. We do not always need the most expensive item to have an item that suits our needs.

The Real Price

Companies and salespeople are not always upfront with us when they are trying to get us to buy something. Most are honest, but remember they all make money when you buy something from them. It is your responsibility to make sure you understand the real price of the item or service you agreed to pay for.

Some companies and salespeople use tricks to make you think something is cheaper than it really is. You need to focus on the real cost. On some bills you receive in the mail, the real amount you have to pay is written smaller than the line that tells you how much you saved this month. In large bold lettering the bill might say “YOU SAVED $17.50 THIS MONTH.”

On some credit card bills, the minimum monthly payment is easier to find than the line that tells you how much you actually owe. If you only pay the minimum payment, the credit card company will charge you interest on the outstanding balance. When you do not pay the entire amount on your bill, companies charge you extra money. You are really borrowing the rest of the money you need in order to pay the bill and the company is charging you to use their money. This is called interest. If your interest charges are high, you will have less money for other things you want and need.

When using services, you should try to focus on ‘the fine print’. That means you have to understand all the details about how much an item or service will really cost you. Sometimes a company will advertise their product for a cheap sounding price. This is meant to make us interested and walk into their store or get on the phone with one of their salespeople. In their advertisement they do not always make it clear that other costs will be charged to you when you purchase their item or service. It is your responsibility to make sure you understand and are able to pay the real cost before you agree to buy something. For example, a cell phone company might offer you a free phone. When you go to get your free phone you discover they have added all sorts of other charges, such as activation fees, fees for airtime and texting, taxes and other service fees. This so called ‘free phone’ could end up costing you hundreds of dollars every month.

If you sign into a contract with a company for services, such as cell phone plans, they often offer good looking deals. This deal may or may not be the right plan for you. Before you sign anything think about it and have a person you trust look it over. Once you agree to enter into a contract with a company you have to pay them ever month until the contract is over. The contract could last for as long as three years. If you cancel the contract before the term is up you could be charged an ‘early cancellation fee.’ These fees range from $200 to $500 on average.

There are many hidden costs a company or salesperson may not make clear to you. If you are unsure, bring someone you trust with you before agreeing to make your purchase, especially if this purchase could end up costing you a lot more than you originally planned.

Sales Tax Explained

The sticker price you see on the product does not include sales tax. The sales tax will be added at the sales desk when you pay for the item. In Ontario, most products have a 13% sales tax added.

Telephone Sales Calls

Companies want your business. They want you to buy stuff from them. This is how they make their money. Phone calls to your home or cell phone are one way they try to convince you to spend your money. Be very careful about agreeing to purchase an item or service from a company over the phone. When you give your verbal consent, this means you say ‘yes’ to buying something without signing a contract. Saying ‘yes’ over the phone to them means you agree to the terms of their contract. When you answer these calls the person on the phone wants you to say ‘yes’ right away. You do not have the opportunity to think it over or talk about it with someone you trust. You also are not given any written information to look over.

When on the phone with a telephone salesperson you can tell them ‘no’, you are not interested. You can also hang up the phone. They can be very pushy and persuasive. Do not be pressured into agreeing to buy something you really do not want. Say NO and hang up.

If they are offering something you may actually want, it is still a good idea not to say ‘yes’ right away. Tell them to send you information or to call back another time, when you have a trusted person to assist you with the phone call.

Adding your phone number to the “no call list” should stop most of these calls from telephone salespeople. This is a national list and companies are not allowed to call phone numbers on this list to try to sell things to them. For more information on the “No Call List” click here: https://www.lnnte-dncl.gc.ca/index-eng

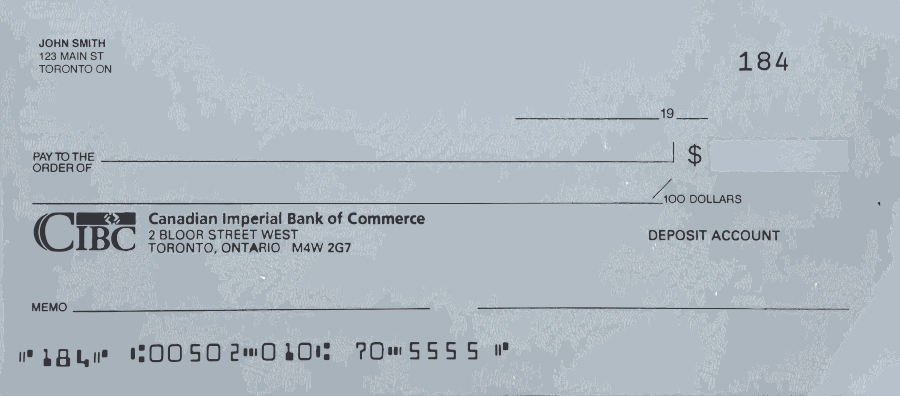

Money Marts and Rent to Own

An easy way to enable you to buy something quickly, even if you do not have the money, is to buy it using services such as Money Mart or Cash 4 You. THESE SERVICES CAN COST A LOT OF MONEY. They let you borrow money but they also charge you a lot of interest. This means you end up having to pay them back a lot more money than you originally borrowed. These services also let you cash your cheque early or will cash it without putting a hold on the cheque, as banks often do. They take money off of your cheque to do this. It may be convenient, but it is also expensive.

Rent to Own stores are also an easy way to purchase something, when you do not have money to pay for it. These stores let you have the item you want right away, but make you sign a contract to make payments every month. The contracts are for two to three years. Once you finish all your payments, the item you purchased will end up costing close to three times the amount you could have bought it for at a regular store.

When it comes to spending your money, ALWAYS work with or consult someone you trust to help you plan ahead. This could be a parent or a worker. By budgeting you can set money aside each month until you have enough to buy it. If you live by the rule ‘Don’t buy something until you can afford it!’, you will never have to pay companies money for interest. You will have more money for yourself and for the things you really want and need.

For tips on how to save money to buy something you want check out the article Simple Strategies to Help You Save Your Money.