Overview:

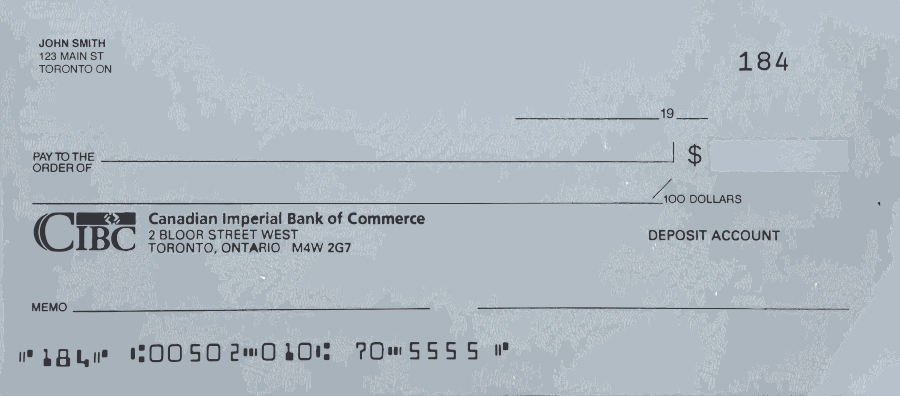

Ontario introduced a new photo card that will provide government-issued identification to more than 1.5 million Ontarians who do not drive. The Ontario photo card makes it easier for non-drivers to perform everyday activities such as cashing a cheque or returning items and goods to a store.

The Cost is $35.00

4-6 weeks for delivery

Ontario Photo Card Website: http://www.ontario.ca/government/ontario-photo-card

The benefits of the Ontario photo card?

An Ontario photo card is government-issued photo identification that allows non-drivers aged 16 years and over to access government, financial or business services that require proof of identity. This proof of identity can be used for things such as: cashing a cheque, opening a new bank account, obtaining a credit card, boarding a domestic flight, returning goods to a store, obtaining hotel accommodation and renting a home video.

Who is eligible for an Ontario photo card?

People living in Ontario who are 16 years of age or older who do not hold a driver’s license are eligible for the Ontario photo card. People with a driver’s license will have their driver’s license cancelled when they apply for a photo card as you cannot hold a valid driver’s license and a photo card at the same time.

The information needed to complete the form includes: Date of Birth, Sex, Height, a Residential address, a mailing address if different. The applicant will need to sign and date the forms. The Public Guardian and Trustee (PGT) will sign the application if it is necessary.

Tip: It is best to make an appointment at your local office. To find out information or to book an appointment for a photo card, please call 416-235-2999 or 1-800-387-3445, or TTY toll-free 1-800-268-7095.

Service Ontario Centres offering photo card services

You will need to bring Acceptable Identify documentation for Ontario Photo Card to the appointment. There are three ways to satisfy this requirement:

- List 1: Only one document is required to satisfy all three data elements

- List 2: Two documents are required to satisfy all three data elements

- List 3: Support Documents

List 1: Identity Documents

| Identity Documents | Legal Name | Date of Birth | Signature |

|---|---|---|---|

| 1. Passport – Canadian | Yes | Yes | Yes |

| 2. Passport – Foreign | Yes | Yes | Yes |

| 3. Canadian Citizenship Card with photo | Yes | Yes | Yes |

| 4. Canadian Permanent Resident Card | Yes | Yes | Yes |

| 5. Record of Landing (Form IMM 1000) Exceptions: see footnotes | Yes | Yes | Yes |

| 6. Confirmation of Permanent Resident Form (IMM 5292) | Yes | Yes | Yes |

| 7. Refugee Status Claim (IMM 1434) Exception: see footnote | Yes | Yes | Yes |

| 8. Acknowledgement of Intent to Claim Refugee Status (IMM 7703) with photo | Yes | Yes | Yes |

| 9. Report Pursuant to the Immigration and Refugee Protection Act (IMM 1442) with photo | Yes | Yes | Yes |

| 10. Student Authorization/Study Permit (Form 1442) | Yes | Yes | Yes |

| 11. Employment Authorization /Work Permit (Form 1442) | Yes | Yes | Yes |

| 12. Visitor Record (Form 1442) | Yes | Yes | Yes |

| 13. Temporary Resident’s Permit (IMM 1442) – formerly Minister’s Permit/Extension of Minister’s Permit | Yes | Yes | Yes |

| 14. Secure Certificate of Indian Status Card – issued by the Canadian Federal Government | Yes | Yes | Yes |

| 15. Driver’s License or Enhanced Driver’s License – issued by Ontario | Yes | Yes | Yes |

List 2: Two documents are required to satisfy all three data elements

| Identity Documents | Legal Name | Date of Birth | Signature |

|---|---|---|---|

| 1. Birth Certificate issued by a Canadian or US jurisdiction | Yes | Yes | N/A |

| 2. Certified Copy of Marriage Certificate (issued by Ontario only) | Yes | N/A | N/A |

| 3. Certified Copy of Statement of Live Birth (issued by Ontario only) | Yes | Yes | N/A |

| 4. Canadian Certificate of Indian Status – issued by the Canadian Federal Government | Yes | N/A | Yes |

| 5. Driver’s License or Enhanced Driver’s License – issued by another Canadian or a US jurisdiction | N/A | N/A | Yes |

| 6. Identity Card – issued by a Canadian or US jurisdiction | N/A | N/A | Yes |

| 7. Ontario Health Card | N/A | N/A | Yes |

| 8. Ontario Student Card with signature | N/A | N/A | Yes |

| 9. Declaration from a Guarantor SR-LD-40 | N/A | N/A | Yes |

| 10. Department of National Defense (DND) identity card | N/A | N/A | Yes |

List 3: Supporting Documents

| Identity Documents | Legal Name | Date of Birth | Signature |

|---|---|---|---|

| 1. Government issued proof of marriage document Canadian or foreign issued by federal/provincial/territorial/state government original or certified copy Support document for proof of change of surname only. This support document allows applicant to adopt spouse’s surname for use on Ontario photo card. Religious institution/church/ceremony-issued proof of marriage documents are not acceptable. |

Yes | N/A | N/A |

| 2. Change of Name Certificate (Canadian or foreign) issued by federal/provincial/territorial/state government Support document for proof of change of name only. | Yes | N/A | N/A |

| 3. Court Order, showing legal name, date of birth and court seal obtained for purposes of name change, divorce, or adoption Support document for proof of change of name, change of surname only, for adoption, and for change to date of birth (as proof of new name and date of birth). | Yes | Yes | N/A |

| 4. Sworn Affidavit with support documents Where no date of birth or only partial date of birth (e.g. only the year) is available, a Sworn Affidavit with support documents is required to confirm the date of birth. | N/A |

Tip: Be sure to bring the completed application form and the required identification to your appointment. It would be a good idea to bring someone you trust with you when you go to the appointment. This person can be a great support and very helpful if there is something you don’t understand or there are difficulties with your application.